Ministry of Finance : Union Finance Minister Smt. Nirmala Sitharaman launches NPS Vatsalya in New Delhi today

NPS Vatsalya is an important constituent towards fulfilling vision of the Prime Minster, Shri Narendra Modi, in creating Viksit Bharat@2047: Smt. Sitharaman

NPS Vatsalya scheme is a significant step by the Government towards inclusive economic development: MoS Finance Shri Pankaj Chaudhary

Recent reforms have expanded scope of pension coverage, aiming to create a more inclusive system through more products: DFS Secretary

NPS Vatsalya is Government’s forward-thinking approach, under the overarching objective of provision of social security for all: PFRDA Chairman

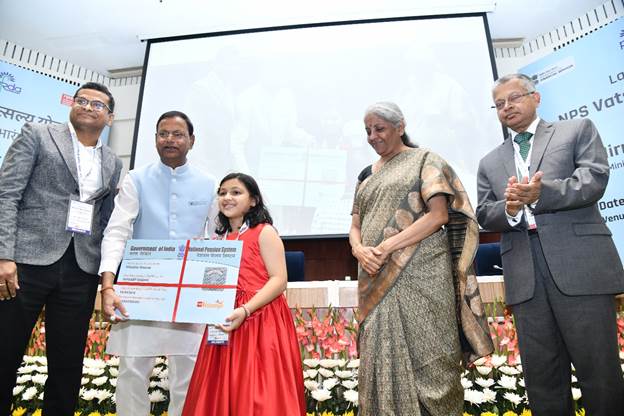

Union Finance Minister also launched an online platform for subscribing to NPS Vatsalya and released the scheme brochure

Smt. Sitharaman and Shri Chaudhary also distributed PRAN cards to minor subscribers from different parts of the country

Posted On: 18 SEP 2024 8:15PM by PIB Delhi

Union Minister for Finance and Corporate Affairs Smt. Nirmala Sitharaman launched the National Pension System Vatsalya (NPS Vatsalya) scheme, ‘a pension scheme for minors’ at New Delhi, today. The NPS Vatsalya was announced by the Union Finance Minister in the Union Budget 2024-25 on 23rd July, 2024.

Union Minister of State for Finance Shri Pankaj Chaudhary; Shri Nagaraju Maddirala, Secretary, Department of Financial Services (DFS); and Shri Deepak Mohanty, Chairman Pension Fund Regulatory Authority of India (PFRDA) were also present besides senior officials from DFS and PFRDA along with school children, their parents and other esteemed guests.

The launch of NPS Vatsalya was simultaneously organised at 75 locations throughout the country, with distribution of over 250 PRAN to minor subscribers. At all the locations, school-going children enthusiastically attended the event.

During the event, Union Finance Minister also launched an online platform for subscribing to NPS Vatsalya, released the scheme brochure.

Smt. Sitharaman also released a brochure, detailing the features of the NPS Vatsalya scheme.

Smt. Sitharaman and Shri Chaudhary also distributed permanent retirement account number (PRAN) cards to minor subscribers who had come from different parts of the country.

In her keynote address at the launch, Union Finance Minister Smt. Nirmala Sitharaman said that the scheme will be an important constituent towards fulfilling vision of the Prime Minister, Shri Narendra Modi, in creating Viksit Bharat@2047.

Smt. Sitharaman said that NPS Vatsalya is a significant step in Government’s endeavour to promote long-term financial planning and security for all the citizens. Besides securing the future of subscribers, NPS Vatsalya is based on the principle of intergenerational equity by providing cover to older and young members of the family.

It is envisaged that NPS Vatsalya scheme will inculcate the habit of savings among young subscribers and large wealth can be accumulated through power of compounding. The Union Finance Minister emphasised that the scheme will allow dignified life to people in their old age.

Commending the success of Atal Pension Yojana, the Union Finance Minister said, “Since its inception in 2015, 6.90 crore people have subscribed to the Atal Pension Yojana and the corpus worth Rs 35,149 crore has been accumulated.”

Underling the competitive returns in NPS scheme since its inception, Smt. Sitharaman said, “For the Government Sector, NPS, on average, has given returns of 9.5% Compound Annual Growth Rate (CAGR) since its inception.”

In his address on the occasion, Union Minister of State for Finance Shri Pankaj Chaudhary said that NPS Vatsalya scheme is a significant step by the Government towards inclusive economic development and all the institutions involved in scheme implementation were urged to ensure maximum coverage and saturation of the scheme.

In his address on the occasion, Shri Nagaraju Maddirala, Secretary, DFS, underscored the imperative of collaborative approach by stakeholders including banks for effective implementation and outreach of the NPS Scheme.

Shri Maddirala said that efforts are being made to include more workers from the informal sector into the pension fold. Comprehensive financial education and literacy campaigns by DFS targeted towards pensions are implemented to raise awareness about the importance of retirement planning and the benefits of participating in pension schemes.

Shri Maddirala said, “The pension sector in India is at a crucial juncture. Recent reforms have expanded the scope of pension coverage, aiming to create a more inclusive system by offering more products through higher number of channels. We endeavour to build a more inclusive and sustainable pension system by keep reforming and be receptive of subscriber feedback and concerns.”

In his address at the launch, Dr. Deepak Mohanty, Chairperson, PFRDA, said, “It is the Government’s forward-thinking approach, under the overarching objective of provision of social security for all, that NPS Vatsalya is launched today. It enables us to tap into the power of compound interest, potentially leading to substantial wealth accumulation over time securing the financial future of our younger generation.”

In the matter of pension an early start is a head start: small amounts squirreled away could yield substantial corpus by harnessing the power of compounding. People often have various financial priorities and may not always consider retirement planning until later in life which often results in inadequate old age income. Thus, there was a felt need for a pension scheme inculcating a culture of early saving and investment.

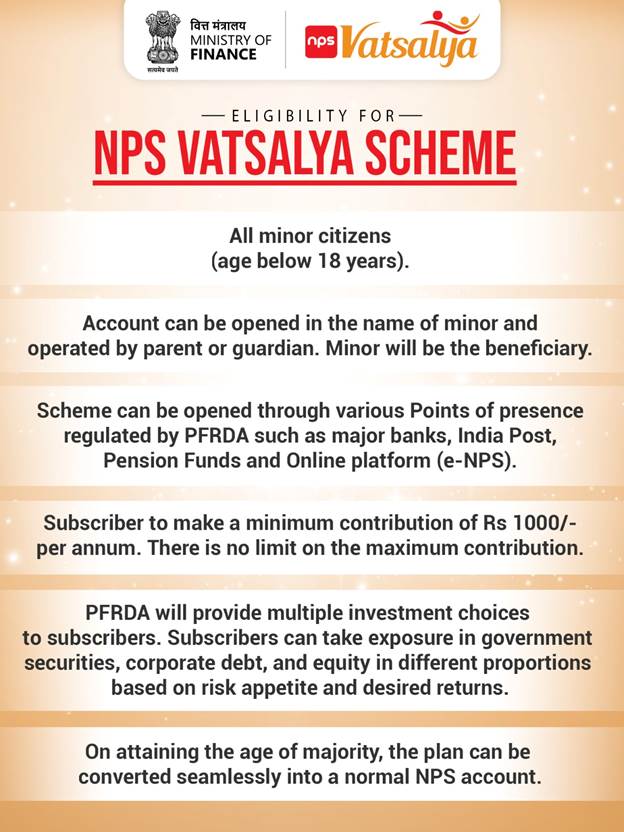

Eligibility for NPS Vatsalya as follows:

- All minor citizens (age below 18 years).

- Account can be opened in the name of minor and operated by parent or guardian. Minor will be the beneficiary.

- Scheme can be opened through various Points of presence regulated by PFRDA such as major banks, India Post, Pension Funds and Online platform (e-NPS).

- Subscriber to make a minimum contribution of Rs 1000/- per annum. There is no limit on the maximum contribution.

- PFRDA will provide multiple investment choices to subscribers. Subscribers can take exposure in government securities, corporate debt, and equity in different proportions based on risk appetite and desired returns.

- On attaining the age of majority, the plan can be converted seamlessly into a normal NPS account.

****

NB/KMN